The Better Letter: Best Story Wins

For most of us, most of the time, truth is a matter of the imagination.

Every right-thinking person’s preferred narrative about eastern Europe should favor the plucky underdog over the authoritarian bear. Factor in Ukraine’s monumental information warfare dominance – the primary advantage it has – and we are all ripe for misreading and misunderstanding what is going on (the fog of war and all that). It’s hard to know what’s real and what’s true.

This week’s TBL focuses on the importance of narrative: the best story usually wins in the battle of ideas. In Ukraine, let’s hope against hope the best story wins the (literal) war, too.

If you like The Better Letter, please subscribe, share it, and forward it widely. It’s free, there are no ads, and I never sell or give away email addresses.

Thanks for reading.

Best Story Wins

It was March 2009, in the depths of the Great Financial Crisis, and PIMCO was still run by the “Bond King,” Bill Gross. Since its founding in 1971, the firm had been essentially all-in on bonds and had ridden the nearly three-decade-long bond rally to enormous success, gathering nearly $1 trillion in managed assets. Since roughly 1981, the more bullish you were on bonds, the longer your duration, and the more convexity you owned, the more money you made.

For most of that time, PIMCO was very long bonds, duration, and convexity.

But Gross had a problem. He thought the glory days for bonds were over. Thus, he believed PIMCO needed to diversify. The Bond King moved PIMCO into other asset classes, especially equities, in a big way, with special focus on international stocks.

Gross needed a new narrative to support such a big change in approach.

He called that narrative “The New Normal,” a term that Gross coined to describe what he forecast to be the defining elements of the economic and market landscape for years, or perhaps decades, to come. He thought the future would likely include a lowered living standard, high unemployment, stagnant corporate profits, heavy government intervention in the economy, and disappointing equity returns, especially domestically. With interest rates already historically low, he didn’t think investors could expect much from bonds, either. He predicted Americans would shift from risk to thrift for at least a generation.

The appeal worked because the markets felt so different. The S&P 500 lost 36.55 percent in 2008. Of course what had been normal wasn’t normal anymore. Or so it seemed.

Bill Gross was wrong pretty much across-the-board and continued to be wrong.1 Most prominently, U.S. stocks went on a tremendous roll. Bonds continued to do well. Only foreign stocks lagged. Wrong, wrong, and wrong. That prodigeous wrongness coupled with general weirdness (lots and lots of weirdness) pushed him out of PIMCO in 2014. After he left PIMCO, he continued to be wrong until he finally retired in 2019.

The “new normal” narrative wasn’t really a thing anymore by the time Gross left PIMCO, but it had done exactly what it was designed to do. Despite being substantively wrong on just about everything from 2009-2014, PIMCO assets roughly doubled to $2 trillion. Good narratives win battles of ideas. Stories trump statistics.

And if the right “influencer” is pushing it with an effective narrative, a demonstrably bad product will sell big. The Bond King was a great influencer during that period, as Jason Zweig explained.

“You never knew when Mr. Gross would talk about his own belly fat, the death of his cat or the implications of demographic change on bond prices. In countless television appearances, he wore his necktie unknotted like a sash, a cowlick of sandy hair cantilevered off the side of his head. Other than Warren Buffett, Mr. Gross is the most recognizable investor in the world.”

Whether we like it or not, stories are really, really powerful. National Geographic, for example, “believe[s] in the power of science, exploration, and storytelling to change the world.” An oft-cited Ohio State study found that a message in story form is up to 22 times more memorable than disconnected facts alone.

As explained by mathematician John Allen Paulos, “There is a tension between stories and statistics, and one under-appreciated contrast between them is simply the mindset with which we approach them. In listening to stories, we tend to suspend disbelief in order to be entertained, whereas in evaluating statistics we generally have an opposite inclination to suspend belief in order not to be beguiled.” The Significant Objects Project allowed researchers to sell worthless baubles on eBay for surprising amounts when they linked each one to a compelling story.

We are hardwired to respond to narrative such that a good story doesn’t feel like a story – it feels exactly like real life, but is most decidedly not like real life. It is heightened, simplified, enhanced, and edited. We prefer rhetorical grace and an emotional charge to precise linearity and the work of hard thought. Because we are inveterate simplifiers, we prefer clean and clear narrative to complex reality. As Hannah Arendt explained, “storytelling reveals meaning without committing the error of defining it.”

Reality is messy. Stories? Not so much. Stories can never be truly ordinary or they wouldn’t resonate. There needs to be narrative arc or we won’t stick around. Our lives are ordinary, and we want to experience the extraordinary, to imagine being extraordinary. If the characters in a story are too real, it wouldn’t be a very good story.

Our narrative-drunk brains aren’t all that interested in reality. The great actor and filmmaker Orson Wells threateningly intoned against the narrative overlay of pretty much all we do and are in the sort-of documentary F For Fake: “almost any story is almost certainly some kind of lie.” Much like Daniel Defoe’s famous description of the novel as “lying like truth,” Robert McCrum said, “The moral drive of fiction is faithfully to ‘get it right’ through the contrivance of making it up.”

As Bob Dylan put it: “[L]ife is more or less a lie, but then again, that’s exactly the way we want it to be.” The PIMCO story in headline form over this period is a surprising one unless you understand the power of a good narrative.

PIMCO 2009-2014: Great Story; Spotty Substance; Assets Double.

As ever, for most of us, most of the time, truth is a matter of the imagination. The best story wins. That’s the old and new normal.

Totally Worth It

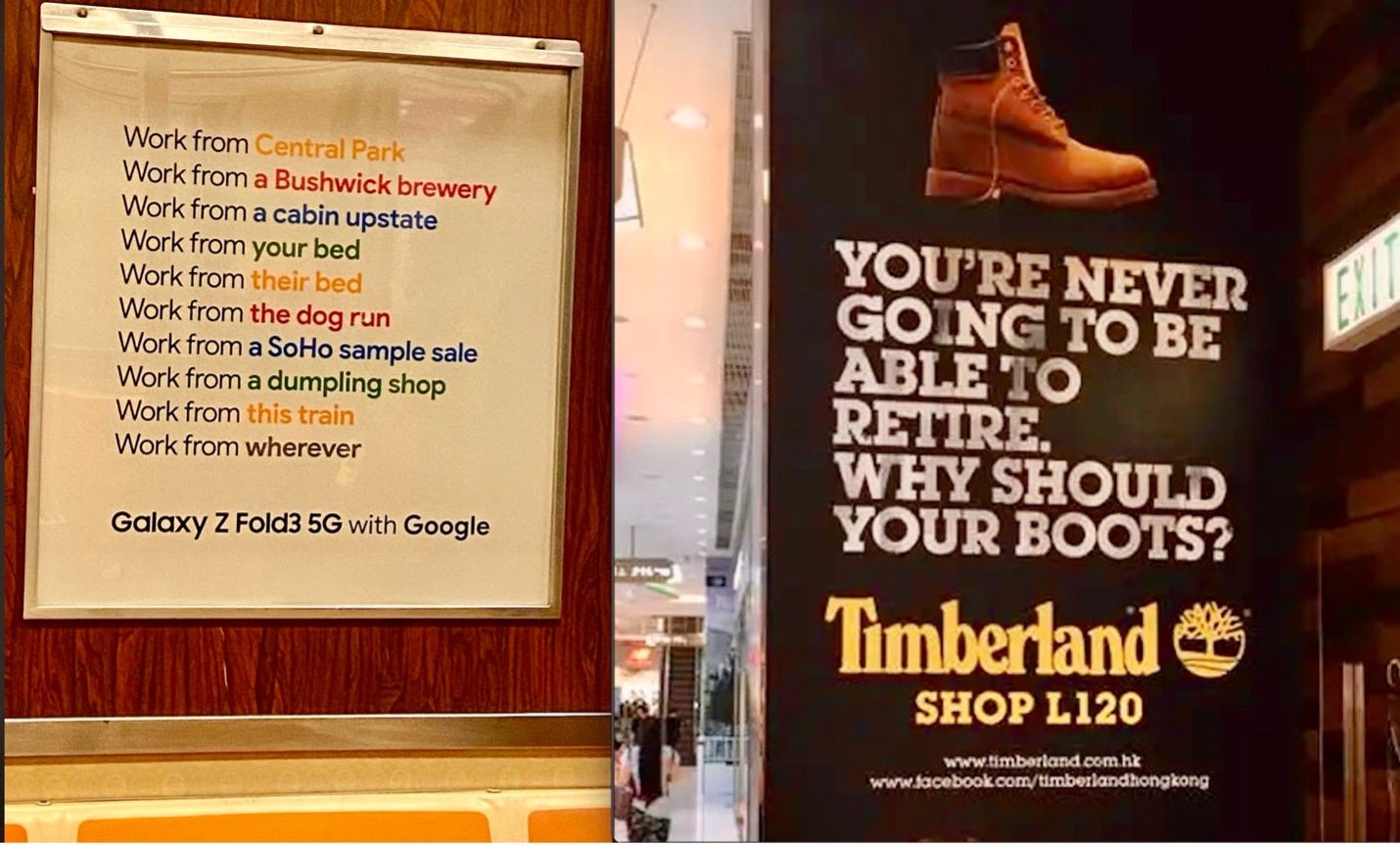

Do you want to die with your boots on?

The ad on the left is no slouch, but the one on the right may be the most depressing ad ever. Source: The Guardian.

“There is a profound difference between the use of force for liberation and the use of force for conquest.”

You get on a ski lift at the bottom of the mountain and take it all the way up to the top. What fraction of the lift’s chairs do you pass? Solution below (from here).

Most memorable quote: Ukrainian President Volodymyr Zelensky was in the streets of Kyiv, refuting rumors that he had fled. He flatly refused a reported American offer of evacuation, declaring, “The fight is here. I need ammunition, not a ride.”

Feel free to contact me via rpseawright [at] gmail [dot] com or on Twitter (@rpseawright) and let me know what you like, what you don’t like, what you’d like to see changed, and what you’d add. Praise, condemnation, and feedback are always welcome.

Don’t forget to subscribe and share TBL. Please.

Of course, the easiest way to share TBL is simply to forward it to a few dozen of your closest friends.

This is the best thing I saw or read this week. The coolest. The scariest. The sweetest. The saddest. The smartest. The funniest. The bravest. The wildest. The most significant. The most promising. The most practical. The most predictable. The most hopeful. The best leadership. The best advice. The biggest bust. The biggest lie. Insect porn. Outsmarted by birds. Beware the cool mom. Uh-oh. All-in. The hottest hand. The best piece on sanctions. MLB has cancelled games – and it’s all the owners’ fault.

Please send me your nominees for this space to rpseawright [at] gmail [dot] com or via Twitter (@rpseawright).

Solution: You pass all the ski lift’s chairs (except, of course, your own). The lift is like a loop of string on a pulley. The chairs are suspended from all parts of the loop. Because one half of the loop carries chairs downward as the other half carries them upward, chairs pass you with a relative speed that is twice that of the pulley itself. In taking the lift up, you traverse just half of the complete loop. But since the relative speed is twice the pulley’s speed, you pass 100 percent of the loop and thus all the chairs other than your own.

The Ukrainian border guard’s taunt of defiance on Snake Island — “Russian warship, go f*** yourself” — deserves a place in history beside μολὼν λαβέ and Patrick Henry’s “Give me liberty or give me death.” Oh, and the Snake Island soldiers survived.

The Spotify playlist of TBL music has been divided in two. A Christmas music edition has been split off from the regular version so you needn’t listen to Christmas music in March – not that that’s a bad thing. The regular TBL playlist now includes more than 200 songs and about 14 hours of great music. I urge you to listen in, sing along, and turn the volume up.

Benediction

This week’s benediction comes from Ukraine. A full version of the first song, in English, is here.

To those of us prone to wander, to those who are broken, to those who flee and fight in fear – which is every last lost one of us – there is a faith that offers grace and hope. And may love have the last word. Now and forever. Amen.

Thanks for reading.

Issue 104 (March 4, 2022)

PIMCO was badly wrong, but performance wasn’t nearly as poor as it might have been because fixed income — a huge percentage of firm assets — did far, far better than Gross predicted.