I have written before about the “Semmelweis Reflex,” our tendency reflexively to reject new evidence or new knowledge because it contradicts our established norms, beliefs, or paradigms. Jess Zimmerman said it like this: “By the time my friends told me I shouldn’t, it was too late for me to listen.”

We’re going to be wrong a lot. That’s a given. Accordingly, we can’t hold onto our ideas too tightly. Instead, we need to be on a constant hunt for error. When we find it, we need to admit it and fix it, rinse and repeat.

But that’s really hard to do. Every rational person acknowledges being far, far from perfect. But nobody seems willing or able to come up with any current errors.

We tend to think that if our ideas – even strongly held, important ideas – are contradicted, we’ll change our minds. We expect education, science, and critical thinking to save the day.

As if.

We’re the heroes of the stories we tell ourselves about ourselves. We’re convinced of our own genius and self-righteousness. We’re overconfident. And none of us is as smart as we think (Hello, Dunning-Kruger effect!).

This week’s TBL will provide yet another example.

If you like The Better Letter, please subscribe, share it, and forward it widely.

NOTE TO SUBSCRIBERS: Some email services may truncate TBL. If so, or if you’d prefer, you can read it all here. If it is clipped, you can also click on “View entire message” and you’ll be able to view the entire missive in your email app.

Thanks for reading.

Could It Be True?

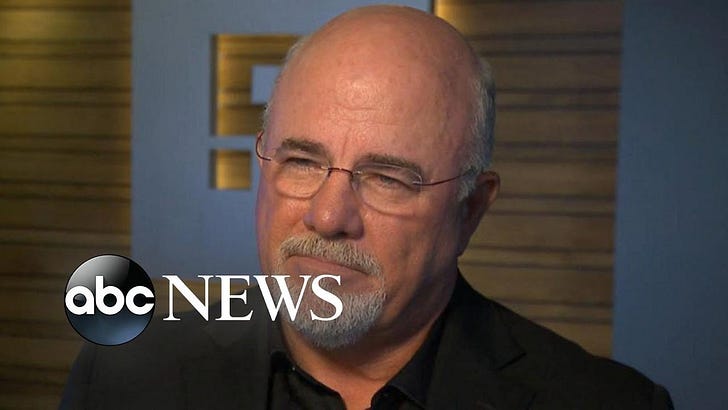

David Lawrence Ramsey III is a big-time American radio personality, especially in “Flyover Country,” with over 13 million listeners. He offers tough-love financial advice, hosts a nationally syndicated radio program, and has written several books. Did I mention that he’s a big deal?

Dave’s main themes focus on morality, character, and changing the culture. He spends way more time on how to save $1,000 than on what your investment portfolio should look like. His core message – that the only reliable way to obtain financial peace is to pay off your debts, live within your means, and accumulate savings – is terrific. He is to be commended for all of that. He is also to be commended for emphasizing that an investor’s rate of saving is far more important that his or her rate of return.

Excellent, so far.

However, he also makes other claims that are, shall we say, a bit more problematic. Have a look at the following. It’s almost all powerful and good stuff, with one major error.

Did you catch it?

If you invest $529 a month from age 30 to age 65 with a decent growth mutual fund in a Roth IRA you’ll have $5.6 million.

I couldn’t make that math work at all plausibly. Here’s about as close as I could come.

Maybe he simply made a mistake. Maybe he misspoke. Maybe he oversold his product.

In a recent interview, Ramsey caused more controversy. Yet again. And in a similar way.

He began with a claim of exceptional investment returns.

“And over the past 30 years, my little portfolio … has averaged 12, most years over 13 percent.”

Since the S&P 500 has long-term performance of 9.89 percent annualized since 1927 (1928-2022), including dividends, and 9.69 percent over the past 30 years (1993-2022), that is a very bold claim.

He has often made this sort of assertion (remember the video above?). Ramsey specifically claims that you really can expect a 12 percent return from the market over the long-term because “[t]here are mutual funds out there that have averaged 12 percent annual returns over the course of their history.” He thinks it’s “a pretty reasonable bet.” He’s also very touchy about being criticized for telling people that 12 percent is a decent expectation.1

That has caused some to question his veracity, but I’m willing to give him the benefit of the doubt, particularly because he has offered clues about that his portfolio looks like and I have followed those clues.

Ramsey has often stated that his investments are allocated to four particular types of mutual fund: growth, growth and income, aggressive growth, and international. He has never stated which funds he uses (as far as I can tell), suggesting his fans use one of his recommended financial advisors, who pay him for the privilege. However, Ramsey has acknowledged on his radio show that he owns American Funds, a family of good, lower-cost, actively-managed mutual funds.

The Investment Company of America (ICAFX: 12.19% per annum since 1934), The Growth Company of America (GFFFX: 13.59% per annum since 1973), New Perspective Fund (ANWFX: 12.25% per annum since 1973), and Fundamental Investors (FINFX: 12.37% per annum since 1978) – all from American Funds – fit roughly into Dave’s mutual fund categories and have long, excellent track records. Thus, if Ramsey has owned them for 30 years, as he says, his claim to have gotten 12 percent overall is a plausible one.

That said, the fact that Ramsey has done well is hardly a guaranty that somebody else will.

Had you bought ICAFX 3, 5, 10, or 15 years ago, and held it, you would have significantly underperformed.

Had you bought GFFFX 3, 5, 10, or 15 years ago, and held it, you would have significantly underperformed.

ANWFX has done great, but FINFX has significantly underperformed over the past 3 and 5-year periods.

Past performance is not indicative of future results. Regulators insist on that disclosure for good reason. The Japanese stock market reached an all-time high on December 29, 1989 but has never gotten back to that level. Returns are not guaranteed. There is no way to know, in advance, where good performance is going to come from or if it will come at all (which is why diversification makes so much sense).

This principle also applies going forward. Today’s best-performing funds, sectors, and stocks will not necessarily perform best in the future. For example, the three worst-performing sectors of the S&P 500 in 2022 (Communications Services, Consumer Discretionary, and Information Technology) were the only sectors to outperform in the first half of 2023.

Here’s what I think is going on. The “great majority of the cross-sectional variation in fund performance is due to random noise.” In other words, Ramsey was lucky with his fund choices.

I’m willing to believe that Ramsey has made 12 percent per annum over the past 30 years. Good for him. But, it’s not reasonable to expect that level of return, now or in the future.

Ramsey made an additional claim, one that it downright ridiculous.

“It’s not really hard to beat the S&P. The S&P is the average of the market.”

First of all, the S&P 500 isn’t “the average of the market,” but I’m willing to let that slide. I think we know what Ramsey meant. But let’s examine his claim that it’s easy to beat the S&P 500.

Most U.S. funds underperform every year. Indeed, over the most recent 20 years, over 93 percent of funds underperformed. More importantly, on a risk-adjusted basis, over 99 percent underperformed. Moreover, the true numbers are even worse than that because most bad funds have have closed or been absorbed.

By way of comparison, Warren Buffett’s Berkshire-Hathaway earned a compound annual gain 19.8 percent from 1965 through 2022, compared with 9.9 percent for the S&P 500. That’s an overall total return of an astonishing 3,787,464 percent versus “just” 24,708 percent for the benchmark. That’s why Buffett is widely regarded as the greatest investor of all-time.

That said, over the past 20 years (2003-2022), the S&P 500 delivered a 9.80 percent annualized return while Buffett came in a touch lower at 9.75 percent. Thus, even Warren Buffett hasn’t been able to beat the market over the past 20 years.

Despite Ramsey's insistence otherwise, it’s really, really hard to beat the market.

Lots of people think they beat the market but really don’t. Maybe they don’t factor in costs and fees. Maybe they use average returns rather than annualized returns (this doesn’t work because a -50% year needs a +100% year to get back to even while the average of -50% and +100% would be +25%; it’s “sequence risk”) – Ramsey does this, and it’s highly misleading.2 Or maybe they don’t know or understand their performance. Research suggests that what people think and claim their investment returns are and what those returns actually are have – quite literally – nothing to do with each other.

Dave is quite thin-skinned when these errors are called out. He keeps insisting that, even if he’s “half-wrong,” folks following his advice will be in good shape. An investment portfolio is a luxurious afterthought. To be sure, most people would be exceedingly well-off if Dave were only half-right about investments, but not all, and, more importantly, these sorts of errors (it’s “easy” to beat the market; you can expect 13% annual returns; use 8% withdrawal rates in retirement) call all of his (mostly terrific) advice into question. Okay, Boomer!

Look, I get it. Nobody wants to think luck played a big part in their success. Not even Dave Ramsey. And he wants others to follow his lead. That’s not bad. But, that’s not all.

Dave was careful and intentional when he created his brand. From a $1,000 emergency fund to a debt snowball, to an emergency fund of 3-6 months salary, to longer-term savings, to investing. It’s all Baby Steps. “Living like no one else, so you can live like no one else.”

My mother didn’t know who Dave Ramsey was, but she used only cash, distributed into different envelopes dedicated to different types of expenses: Dave’s advice applied. And it worked.

As times, circumstances, and situations have changed, Dave’s message and materials have remained predicated upon his experience and thus have stayed utterly static. That isn’t altogether bad, because his values are good.

However, in Dave’s world, you can let everything ride on stocks and the bull market goes on forever. In Dave’s world, an 8 percent retirement withdrawal rate isn’t crazy. In Dave’s world, beating the market is a piece of cake. In Dave’s world, volatility and drawdown risk don’t matter.

Time has provided more data and that data has shown that Dave’s investment theses aren’t nearly as good as his debt theses. In fact, his investment ideas are both dreadful and dangerous. Still, consistent with the Semmelweis Reflex, I don’t expect Ramsey to change. Maybe he’s too arrogant, too impressed with his personal success, or too thin-skinned to do see reality.

But, he doesn’t see it (or pretends not to see it).

Here’s what I suspect. When we see something that confirms what we already think or believe, we mostly accept it as given. If we react at all, we wonder if it could conceivably be true. Somehow. If so (and there is so much information at our disposal today that any reasonably smart person can almost always concoct a scenario by which it’s true), status confirmed.

When we see something that questions, challenges, or contradicts what we already think or believe, on the other hand, we invoke an entirely different and much tougher standard: Must it be true? And there is so much information at our disposal today that any reasonably smart person can almost always concoct a basis for concluding it’s false. Rightness confirmed!

Dave Ramsey seems to have done really well with his investments over the past 30 years. But that doesn’t mean you should expect that level of return or that it’s easy to beat the market. Au contraire. Dave should stick to what he knows and what he’s good at: motivating people to reduce their debt, get on firm financial footing, and start saving.

With respect to the markets, he’s out of his depth. Take his advice at your peril.

Totally Worth It

Feel free to contact me via rpseawright [at] gmail [dot] com or on Twitter (@rpseawright) and let me know what you like, what you don’t like, what you’d like to see changed, and what you’d add. Praise, condemnation, and feedback are always welcome.

Of course, the easiest way to share TBL is simply to forward it to a few dozen of your closest friends.

This is the best thing I read or saw this week. The funniest. Also funny. The silliest. The strongest. The most impressive. The most insightful. The most important. The most ridiculous. The most remarkable. The most dangerous. The most absurd. The least surprising. The best commercial. Reformation Day was last week. Not wrong (NSFW). Duh. Also duh. Chilling. More chilling. Silly and scary. Kids these days. Imagine that. Ladies and gentlemen: The New York Times. Ladies and gentlemen: The New York Times.

You may hit some paywalls herein; many can be overcome here.

Please send me your nominations for this space to rpseawright [at] gmail [dot] com or via Twitter (@rpseawright).

The TBL Spotify playlist, made up of the songs featured here, now includes over 260 songs and about 19 hours of great music. I urge you to listen in, sing along, and turn up the volume.

My ongoing thread/music and meaning project: #SongsThatMove

Benediction

This week’s benediction is a Bob Dylan classic – one of his finest songs – sung by Madison Cunningham.

I hear the ancient footsteps like the motion of the sea Sometimes I turn, there's someone there, other time it's only me I am hanging in the balance of a perfect finished plan Like every sparrow falling, like every grain of sand

We are all broken in some way or another and wildly prone to screw things up. W. H. Auden got it right.

O stand, stand at the window | As the tears scald and start; | You shall love your crooked neighbour | With your crooked heart.

We live on “a hurtling planet,” the poet Rod Jellema informed us, “swung from a thread of light and saved by nothing but grace.”

This week’s blessing is the most famous of them all, from Numbers 6:24-26.

The Lord bless you and keep you; the Lord make his face to shine upon you and be gracious to you; the Lord lift up his countenance upon you and give you peace.

To those of us prone to wander, to those who are broken, to those who flee and fight in fear – which is every last lost one of us – there is a faith that offers grace and hope. And may love have the last word. Now and forever. Amen.

As always, thanks for reading.

Issue 157 (November 3, 2023)

For example, in a 2014 rant (the primary thrust of which – that people need to invest and financial professionals should do much more to make that so – is entirely correct), Ramsey went so far as to refer to Certified Financial Planners as “Certified Financial Pharisees” and “financial nerds” for questioning his claims.

The SEC explicitly requires that mutual funds use the word “average” but that they report the “average” as the geometric mean – in finance, that’s the compound average growth rate (CAGR). Ramsey is doing what would get financial professionals and firms in serious hot water.

The error of composition. If we all began taking his advice beginning now the economy would crash and few would save anything.