The Better Letter: It Really Is Different This Time

A round-up of 1Q 2020 market performance and more

This is a special quarter-end edition of The Better Letter. If you like what you read, please subscribe (it’s free) and share it widely.

Round-Up

The past few weeks have provided stress-testing for every financial plan and investment strategy in real-time and proved yet again that no investment will ever give you the returns you want in the way you want them.

The speed at which the global coronavirus pandemic has changed the reality we’re facing is stunning. We’ve jumped from a strong economy and a February 19 all-time high on the S&P 500 to a global synchronized economic shutdown, a bear market, and 40,000 reported deaths worldwide (with far more unreported and many more to come) in almost no-time. More Americans have already died from COVID-19 than perished on 9.11, with much worse on tap. Currently, the White House is projecting up to nearly 250,000 American deaths from the virus…if things go relatively well.

As Annie Lowrey wrote, the economy is experiencing a shock “more sudden and severe than anyone alive has ever experienced.” About one in five people in the United States have lost working hours or jobs, with many more job losses virtually certain. Restaurants, bars, and other small businesses are closing. Hotels are empty. Airlines are in trouble. Medical facilities are already feeling the strain.

It really is different this time.

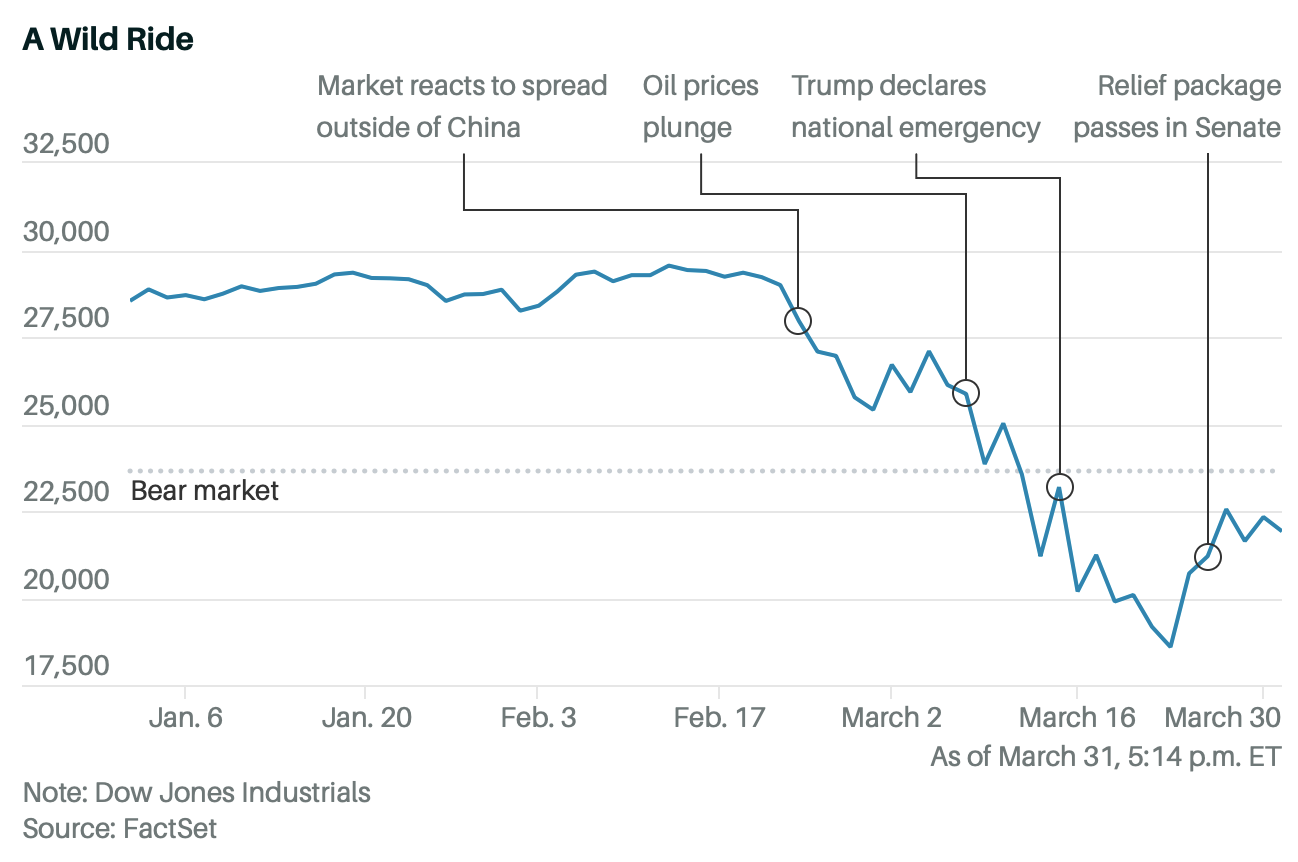

The American response to the threat of COVID-19 was slow at every level. But once the market caught on to the fact that the threat was both real and enormous, the subsequent selling was indiscriminate. Asset owners scrambled to flee positions ranging from stocks to commodities to corporate bonds to emerging market debt, recognizing the global economy was headed for a sharp downturn.

The longest-ever bull market in U.S. history – over 11 years – died abruptly, with declines so sharp that the bull market turned almost overnight into the fastest and sharpest bear market in history.

The S&P 500 posted a 20 percent loss for the quarter, its biggest quarterly decline since 2008. It is the first time in over a decade that the S&P has ended each of the first three months of a calendar year in negative territory, as it did in January (-0.2%); February (-8.41%); and March (-12.51%). The Dow Jones Industrial Average lost 23 percent for the quarter, its worst showing since 1987. The NASDAQ Composite finished the quarter down 14 percent, the “best” among major indexes, as dip-buyers targeted the cash-rich tech mega-caps that make up its core. Microsoft fared the best of them, squeezing out a 0.01 percent quarterly gain. The small-cap Russell 2000 plunged 31 percent for the quarter, the most ever in data going back to 1979.

Volatility has been relentless. The S&P 500’s absolute average percentage daily change in March was an incredible 5 percent, surpassing a previous all-time high set during the Great Depression.

Overseas, the pan-continental Stoxx Europe 600 suffered its biggest quarterly loss since 2002. Japan’s Nikkei Stock Average logged its steepest decline since 2008. China’s Shanghai Composite was relatively strong, losing “only” 10 percent.

Stock market volatility boosted the value of safe-haven assets like U.S. Treasury securities and gold. The yield on the benchmark 10-year U.S. Treasury note, used as a benchmark for everything from mortgage rates to student loans, fell 1.218 percent to 0.691 percent over the course of the quarter, its steepest one-quarter decline since 2011, but still well above the low yield of 0.31 percent reached on March 9. U.S. government bonds were very profitable in the first quarter. Gold also rallied, with the price of the precious metal finishing the first quarter up 4.2 percent, its sixth consecutive quarter of gains.

Still, despite those big losses, it was only a week ago that central bankers, politicians, Wall Street, and investors all over the world were asking when the market turmoil – brought on by the pandemic – would end. Today, as the second quarter of 2020 begins, the question being hotly debated is whether it already has.

The S&P 500 closed the first quarter down big, but more than 15 percent higher than last week’s low, after advancing four days out of the most recent six. Last week was the best week for the benchmark U.S. stock gauge since 2009. Reasons for the possible change in sentiment range from dip buying and short-covering to unprecedented monetary support and the largest fiscal stimulus ever.

Stock markets tend to move months ahead of the economic cycle, offering hope that the worst may be over. However, the full extent of the damage from the pandemic is still unknown and impossible to forecast with much accuracy, suggesting that such optimism might be misplaced.

Since the end of 1927, the index that ultimately became the S&P 500 has experienced 14 separate bear markets, defined as beginning any time the gauge closes more than 20 percent below a record peak. Assuming a bear market continues until the index either doubles from a post-peak low or climbs above its pre-bear high, the average duration of these bear markets has been 641 days.

Obviously, the nature of this decline – brought on by an external event while markets and economies were strong – suggests that this recovery might be faster than that. Even more obviously, everyone hopes so.

Goldman Sachs revised its forecast for second-quarter U.S. growth lower to an annualized negative 34 percent, with unemployment increasing to 15 percent. Other forecasts see unemployment soaring as high as 32 percent. Still, Goldman economists see a mainly short-term hit, expecting a strong rebound in the third quarter. More specifically, Goldman sees a harrowing first half followed by a rebound in the second half (12 and 10 percent in its two quarters), for a 2020 overall slide of 3.1 percent.

Elsewhere, Deloitte sees a 2020 slide of 2.3 percent. Raymond James expects the second quarter to fall by as much as 15 percent, while Oxford Economics is calling for a 12 percent drop. The Conference Board has three outlooks for 2020 with the results hinging on how long the virus persists: “In the ‘May reboot’ scenario, GDP growth will shrink by 1.6 percent in 2020 (over 2019). In the ‘summertime V-shape’ and ‘fall recovery’ scenarios, the contraction will be much stronger (5.5 and 6 percent, respectively).” Among the direst forecasts is IHS Markit’s, calling for a 5.4 percent shrinkage of GDP this year.

Hopes for the shutdown being relatively brief were bolstered by signs of stabilization in the number of new cases of the virus reported in the worst-hit areas of Europe, with the World Health Organization saying the outbreak in Italy and Spain may have peaked. While numbers from the U.S. are likely to continue to get worse, the rise in confirmed cases in New York seems to be slowing.

However, there is very little economic data to establish what is happening and in what amounts. It isn’t rocket science to say we’re in a recession. Much of the economy is closed. But not even the greatest rocket scientist in the world can back up that reality with hard numbers at this point.

The likely best-case (but still bad) scenario would require the U.S. to start bending the infection curve sometime in April, allowing workers to return to their jobs by May or June, while the federal government's rescue programs stem the flood of layoffs, allowing GDP to rebound in the third and fourth quarters.

Because medical and scientific experts think it will likely take longer to bend the curve (depending upon how well we comply with lockdown procedures), the most likely scenario has lockdowns continuing into the summer. “We have no certainty the virus will be gone by the end of the second quarter,” Nobel laureate Joseph Stiglitz said. In that case, economic growth could remain negative throughout the year, and further stimulus would be needed.

Suffice it to say that the worst-case (but least likely) scenario is worse than that.

There is no sugar-coating it. The first quarter of 2020 was dreadful – the worst quarter since 2008. Where we go from here will largely depend on something well removed from markets generally: what happens with COVID-19. As John Authers wrote early this morning, “Nothing transcends the importance of the fight by public health authorities against the pandemic.”

It really is different this time, but what’s different has nothing to do with the markets and everything to do with a deadly virus and our response to it.

Empires of Dirt

Since all of us feel like our “empires of dirt” are in jeopardy, and all of us are hurting, at least to some degree, there is an extra reason to listen to Johnny Cash and his song, “Hurt,” today. The main reason is that he’s excellent.

Comfort Food

During difficult times, we all appreciate comfort food, literally and figuratively. Among my favorite comfort foods are sports movies, especially those featuring “Cinderella stories” (which are essentially all of them). Here are my favorites, in ascending order, with video links to scenes with my favorite lines from them. As always, your mileage may vary.

12. The Natural: “One more, Roy.”

11. Field of Dreams: “Go the distance.”

10. Remember the Titans: “You make sure they remember forever the night they played the Titans” (NSFW).

9. White Men Can’t Jump: “Slow, white, geeky chump” (NSFW).

8. Bull Durham: “Candlesticks always make a nice gift” (NSFW).

7. Hoosiers: “I’ll make it.”

6. Major League: “I’ve been cut already?” (NSFW).

5. A League of Their Own: “There’s no crying in baseball” (NSFW).

4. Friday Night Lights: “Your job is blockin’ for Boobs” (NSFW; the television show is even better).

3. Moneyball: “We’ll find value in players no one else can see.”

2. Miracle: “You were born for this.”

1. Chariots of Fire: “It was not the prettiest quarter I’ve ever seen, Mr. Liddell, but certainly the bravest.”

If movies aren’t enough, or you prefer real-life Cinderella stories, here are 40 great historical sports moments you might want to watch (or re-watch). And here is a movie streamer’s guide to political literacy.

Market Monitor

Issue 6 (a special quarter-end edition: April 1, 2020)