The now-defunct Bear Stearns won a noteworthy 2002 legal action involving former Fed Governor and then-Bear Chief Economist Wayne Angell over advice he and the firm gave to a Bear Stearns client named Count Henryk de Kwiatkowski (really) after the Count lost hundreds of millions of dollars in a just a few weeks (really) following that advice by trading currency futures on margin (really).

The Count was born in Poland, escaped invading Nazis, been banished to Siberia by the Soviets, escaped and traveled across Asia on foot to Tehran, talked his way into the British Embassy, became a renowned RAF pilot, moved to Canada, became an engineer, and made a fortune trading used airliners, most famously selling nine 747s to the Shah of Iran over a game of backgammon in the royal palace (really). He also became the owner of the famous thoroughbred racing institution, Calumet Farm (really).

Bear offered the Count “a level of service and investment timing comparable to that which [Bear] offer[ed its] largest institutional clients,” which is not to say that they were any good at it. The key trade was a huge and ultimately disastrous bet that the U.S. dollar would rise in late 1994 and early 1995. At one point, the Count’s highly leveraged positions totaled $6.5 billion nominally and accounted for 30 percent of the total open interest in certain currencies on the Chicago Mercantile Exchange.

It was a sort of GameStop before GameStop.

The trial jury awarded a huge verdict to the Count but the appellate court reversed. The appellate judges determined, quite conventionally, that brokers may not be held liable for honest opinions that turn out to be wrong when providing advice on non-discretionary accounts.

But I’m not primarily interested in the main story. Instead, I’m struck by a line of testimony offered at trial by then-Bear CEO Jimmy Cayne that does not even show up in subsequent court opinions, despite extensive recitals of the facts of the case. The generally “cocksure” Cayne apparently thought that his firm could be in trouble so he took a creative and disarmingly honest position given how aggressive Bear was in promoting Angell’s alleged expertise to its customers. Cayne brazenly asserted that Angell was merely an “entertainer” whose advice should never give rise to liability.

Economists, Cayne testified, “don’t really have a good record as far as predicting the future.” Shockingly, he added, “I think that it is entertainment, but [Angell] probably doesn’t think it is.” I doubt that the Count was entertained or amused. Cayne even noted that Angell did not have a real job description at Bear. “I don’t know how he spends most of his time,” testified Cayne. “He travels a lot and visits people and has lunches and dinners and he is an entertainer.”

Notice that Cayne did not even pay lip service to the idea that Bear’s clients were entitled to the firm’s best efforts based upon the best research (or even their best research). Moreover, he did not seem to think that the Count deserved honesty together with competent advice. For Cayne, the goal was simply to make sales. That the Count lost hundreds of millions of dollars was merely collateral damage.

You should always be aware of who has (and especially who doesn’t have) your best interest in mind — practically, realistically, and legally. Folks who make money on the “vig” (true brokers) are much more likely to survive than those who place real bets, as Bear itself found out not too long after the Count lost his shirt.

The GameStop folks are learning the same lessons.

If you like The Better Letter, please subscribe, share it, and forward it widely. It’s free, there are no ads, and I never sell or give away email addresses.

Thanks for visiting and reading this special edition of TBL.

Don’t Bury the Lede

I’m going to get to GameStop, I promise (I’ve had a bunch of requests). Before I do, however, I want to be sure not to bury the lede. If you are a long-term investor with a solid financial plan, you don’t need to pay attention to any of this. You should have better things to do. As Christine Benz reminds, “Not my circus, not my monkeys.”

Still, this isn’t my first rodeo. It isn't practical simply to implore investors to stick with their plan, even a great plan. Most of us just aren't built that way. And we all are inclined to check out a train wreck like the GameStop story. You might even be inclined to trade on it.

Who doesn’t like the idea of getting rich quick?

Legendary investor Benjamin Graham advised strictly segregating speculations from investments. His key idea in this regard was to set up a small “mad money” account where you can take a flyer if you must. If you must enter the GameStop whirlwind, keep your participation small and controlled, unlikely as that is to be the way things play out.

DISCLOSURE: I have no interest nor any current plan to obtain an interest in GameStop or any other “meme stonk.”

Tourist Money

The bros on Reddit message board WallStreetBets found a winning formula (details here) and, oh, what a story it makes.

The formula requires stocks with a small float, light trading volume, a very large short position, and an army of “investors” willing to buy the name relentlessly. The buy orders eventually cause the shorts to cover their positions by buying more shares, which instigates a self-reinforcing vicious circle: The short-covering causes the price to rise which, in turn, causes more shorts to cover, and further price appreciation, eventually bringing the market to its knees.

This feedback loop is a classic short-squeeze, but the WSB’s added wrinkle is the use options and the leverage provided thereby to exacerbate the price action. It’s called a “gamma squeeze.” Those who hedged the call options they had sold by buying the underlying stock increased the pressure.

Direct calls on social media sites like Reddit for “investors” to coordinate their behavior struck many as sounding a lot like illegal market manipulation. That sounds a lot like sour grapes to me. Still, on Wednesday, the SEC said in a statement it was “actively monitoring the ongoing market volatility.”

All this provides further proof for the old saying that the markets can stay irrational longer than you can remain solvent, as some hedge fund giants have come to find out.

The most prominent stock in this story is GameStop, a troubled retailer that was once a fixture in suburban shopping malls – back when buying video games in person, brick-and-mortar stores, and malls were still a thing. It’s basically Blockbuster, but for video games.

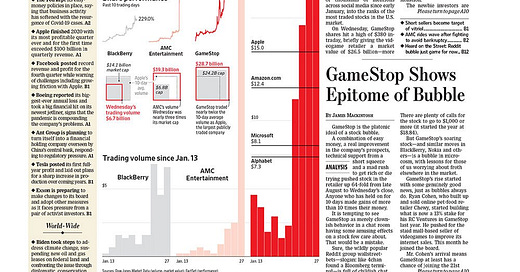

The company lost half-a-billion dollars in 2019, before the pandemic closed stores and crushed revenues. Its stock traded at $56 a share in 2013 before gradually declining to under $5 in 2019. Then the WSB narrative took hold and the stock started to go up. Within the last few days, the story really took hold. The stock rocketed from about $40 a share to more than twelve times that, creating instant riches for some and some big losers, too.

A plot conceived in an off-the-beaten-path corner of the internet was amplified on broader social media platforms before being actualized, chaotically, in the real world. The Redditor slogan, “putting the FU in fundamentals” perfectly illustrates how much the entire fiasco doesn’t make financial sense.

Then, yesterday morning, GameStop trading was restricted on the Robinhood platform, where more than half of all users hold shares in the company, and elsewhere. The stock lost three-quarters of its value in 85 minutes, plunging from nearly $500 to about $120 before rallying to close at $193 and change. Litigation ensued.

Even at the $193 per share level, down hundreds of dollars from the high, $GME is up about 4,500 percent (not a typo) over the past twelve months.

Yesterday’s late rally began when Robinhood announced its plans to allow limited buying of certain highly volatile securities, including GameStop, today. $GME rose 46 percent in post-market trading.

This story is far from over.

The easy explanatory narrative for this turn of events has disruptive outsiders sticking it to the elites. Naturally, The New York Times found a laid-off line cook who is up 1600 percent and quote him saying, “It's crazy.” A nail technician from Louisville, Kentucky, said he discovered Robinhood day-trading as a way to make rent for himself and his elderly mother after the pandemic cost him his job.

All the usual suspects (if not the odd hedge fund billionaire) seem to be piling on the pleasingly populist narrative. Donald Trump, Jr. AOC. Ted Cruz. Dave Portnoy. Rush Limbaugh. Maxine Waters. Tucker Carlson. The Winklevoss twins. Sean Hannity. Elizabeth Warren.

Consider the following quote, also from the Times.

“While the hedge funds and other professional money managers had been shorting GameStop’s shares, betting that its stock was doomed to further decline, the retail investors — online traders, mom-and-pop investors, small brokers, and others — have been pushing the other way, buying shares and stock options. That caused GameStop’s market value to increase to over $24 billion from $2 billion in a matter of days. Its shares have risen over 1,700 percent since December. Between Tuesday and Wednesday, the market value rose over $10 billion.”

This easy narrative is lazy. Wrong, too.

There are professionals on both sides of all these trades. For example, a famous Silicon Valley billionaire with a hedge fund went on CNBC to brag about profiting from a $GME long position and, consistent with his favored narrative (it’s all about the little guy, donchaknow), donating the proceeds to Dave Portnoy’s Barstool Fund. Blackrock is making money on this. Sycamore and a couple of Chinese billionaires are, too.

I mean, you know the richest guy on the planet got this whole thing really moving, right?

The trading volume also shows there’s bigger money at work.

For much of this week, GameStop was the most traded stock in the world, with $20 billion of trading volume per day. 197 million shares traded last Friday alone. Matt Levine, not surprisingly, led the way in pointing this out.

“Surely a lot of professional investors are white-knuckling this thing, buying it as a trade and hoping they can get out before the redditors do. ‘Lol GME to 1000 [rocket emoji] [rocket emoji] [rocket emoji]’ is a perfectly good hedge fund thesis right now. WallStreetBets started this but anyone can jump in now.

“Judging by volumes, everyone has. Yesterday Bloomberg’s Eric Balchunas pointed out that GameStop was ‘the most traded equity on the planet,’ with $20 billion of volume. Tesla was No. 2. GameStop closed yesterday at $147.98, for a market capitalization of about $10 billion, up 93 percent from the day before, up 641 percent from two weeks ago.”

There’s a good conspiracy theory afoot, too. Citadel Securities pays Robinhood a ton of money for their order flow (Robinhood paid a big fine to regulators for not being transparent about it), so the working hypothesis is that Citadel is front-running the Robinhood orders, riding and amplifying the market moves. Levine is dismissive and I am, too. I know from my trading desk days that general flow is far more valuable than front-running. It’s legal, too.

Mohamed El-Erian described a phenomenon common in thin markets – like those in emerging economies – whereby foreign capital rushes into a hot market, completely distorting the internal economics of the nation, driving up prices and, then, at the first sign of trouble, bails, leaving havoc in its wake. He called it “tourist money.” Today, tourist money is looking at thinly traded and struggling American companies like GameStop.

As in Mohamed’s example, today’s tourists aren’t moving in. They are going to sell, probably soon. When they do, the high-flying tourist stocks will come crashing back to earth and the landing won’t likely be pretty, potentially destabilizing the company. For example, GameStop has over 50,000 employees, all of whom are real people and many of whom have families, kids in college, and mortgages. Those jobs will all be at risk.

The silly arguments of the RedditBros – and especially the heinous “spiritual” arguments…

…won’t be much comfort to them then.

The markets will be impacted by this absurdity, too. There will be tremendous pressure for regulators and prosecutors to get involved. Firms that deal with retail consumers will limit access to protect themselves. We don’t know what this will look like yet, but the planning fallacy tells us it isn’t likely to be a net improvement. Moreover, being the backstop of the world’s financial markets and the global economy is boring and normal while also conferring enormous, built-in advantages. These are invisible and taken for granted right up until they disappear.

Most importantly, many of the heroes of the favored narrative – the Redditors said to be disrupting the elites from their mom’s basement – won’t likely come out ahead. Sure, some will pay off student loans or buy a house or finance a successful start-up or otherwise cash out in time and better their lives. But most will buy too much and hang on too long. Anybody with a modicum of experience with bubbles, options, day-trading, or regular ol’ gambling knows how these things tend to play out.

A lot of money is going to be set on fire.

We like to think we’re each the next Michael Burry (played by Christian Bale in The Big Short), an investor who made a fortune because he recognized the mortgage bubble in time to take advantage. But vanishingly few of us become Michael Burry. Most of us turn out to be Wing Chau (played by Byron Mann, talking with Steve Carell – as Mark Baum – below).

Or Sir Isaac Newton. Or even worse. Perhaps much worse.

Think Count Henryk de Kwiatkowski.

A lot of money is going to be set on fire.

Benediction

This isn’t a regular TBL, but I still think a benediction is in order, at least as a sort of palate cleanser after such a dark discussion. Tonight’s comes from Scotland.

Contact me via rpseawright [at] gmail [dot] com or on Twitter (@rpseawright). Don’t forget to subscribe and share.

Thanks for reading.

Issue 50 (January 29, 2021)